“The best duo from start to finish! Made the entire process easy and as stress free as possible. Excellent communication and support.”

Click on our FAQ’s for more details or set up a call.

When others step back, we lean in. We specialize in helping families who want or need time to secure bank financing.

Lease to Own Raleigh homes allow you to:

Either way, we’d love to help you in this pivotal transition. Our resourceful, caring, and expert approach ensures you save thousands of dollars to secure your ideal home by avoiding Buyer’s Closing costs if you choose to buy your Lease to Own home.

Let’s talk today.

“It's heartwarming knowing in this extremely crazy world, there are still people who care about the people. No matter the race or age. Only if there were more people like you guys still in America.”

“If anyone is looking for a trustworthy, dedicated Real Estate Team that will go over and above to help you find your next dream home, this dynamic duo are the perfect pair!...”

“I had such a great experience working with Tamera and Jerry!...Their compassion, professionalism, and expertise all contributed to my overall experience.”

We know the challenge—maximizing deductions makes sense for taxes, but it can make getting approved for a mortgage tough. We’ve been there.

Instead of waiting on the perfect tax return, we leased the home we loved, sorted out our finances, and bought it when we were ready. And you can, too!

Our partners’ Lease to Own Raleigh home-buying solutions are innovative, fiscally-sound, and flexible ways for self-employed buyers to:

— Lease the home you want now and share in the appreciation while you’re leasing

— Buy if/when you’re ready

— Cash out or transfer your wealth to another home

Why settle for renting when you can invest in your future? We’ve helped many self-employed individuals, and we’re here to help you save by waiving Buyer’s Closing Costs.

“Jerry and Tamera found me a home in just a few days!...I cannot effectively state how pleased and comforted I have been by the professional services provided by this friendly and industrious pair.”

James and Mikela, an experienced homeowner couple, were excited about the idea of moving into a new Lease to Own home. Like many households with both W-2 and self-employed income, they were navigating the complexities of securing a traditional mortgage. James had recently landed a fantastic new job, doubling his income, and Mikela was running a successful business. However, they needed a bit more time to gather pay stubs and boost their credit score to qualify for a loan.

That’s where our Lease to Own Raleigh home-buying solution came into play. We showed them a beautiful home and offered them the flexibility to move in right away while they took the necessary time to strengthen their financial profile. Although they ultimately decided to stay in their rental home for personal reasons, their situation highlights a common challenge we help solve.

If you’re an experienced homeowner who needs time to season your employment, boost your credit, or simply secure your financial standing, innovative Lease to Own Raleigh home-buying solutions can provide the flexibility you need. Whether you choose to buy, cash out, or transfer your wealth to another home, we’re here to guide you every step of the way.

Contact us today to learn more about how we can help you secure a home that fits your needs and your lifestyle.

“These two made our house hunting process so simple and stress-free. One tour, and we found our forever home!...They both knew what we were looking for, and made it happen quickly!”

We have helped over 120 families (including ourselves!) move into impeccably maintained Lease to Own homes while securing bank financing to ultimately make their purchases. We help you find your ideal home, and provide game-changing solutions to homeownership. See what others are saying.

“...Tamera and Jerry exceeded our expectations and understood our family's needs and delivered services to find us the perfect home.”

You’ll have the freedom to lease, buy, cash out, or even transfer your wealth to another home. Let us show you how to turn this flexible program into your financial advantage!

Tamera Nielsen, REALTOR ®

Jerry Burson, PA

“Tamera and Jerry are client relationship specialists. Their standard of ethics and genuine perseverance is rare today.”

In our 30 years of experience, we’ve never met a Loan Officer who recognizes rent payments as credit towards your purchase price. Some Owner/Landlords may promise that a portion of your rent will count toward the purchase, but it’s essential to verify this with a Licensed Loan Officer. Only they can confirm if such an arrangement is legal and will be honored in the loan process. However, with our partners’ lease to own Raleigh home programs, you can share in the home’s appreciation and build equity in the home, while leasing! Ask us how.

Most lease-to-own or lease option contracts last 12 to 24 months. We’re excited to offer a 3-5 year lease-to-own option for homes, giving you more time to decide if you want to purchase. You also have the flexibility to cash out, take your share of the home’s appreciation, or transfer your wealth to another home that better fits your needs. Ask us how.

Most Lease to Own home contracts or Lease Options require you the Tenant/Buyer to handle all maintenance and repairs; however, for our Lease to Own homes, our partner handles major repairs, such as HVAC. For full details, ask us.

Whether you’re renting an apartment or living in a lease-to-own home, it’s always a smart choice to protect your personal belongings with renter’s insurance. For this reason, all of our lease-to-own homes do require you to obtain a renter’s insurance policy. If you need help shopping for quotes or finding reputable agents, ask us.

Everyone deserves a fair shot at homeownership! At Burson Home Advisors, we’re committed to helping you access housing opportunities without barriers. Our Fair Housing Resource Guide is packed with helpful tools—from community insights to school ratings and housing laws—so you can make informed, confident decisions.

The answer depends on several factors, including land costs, labor, and materials. We contributed expert insights to a Redfin article that breaks down this topic in depth. Read it here.

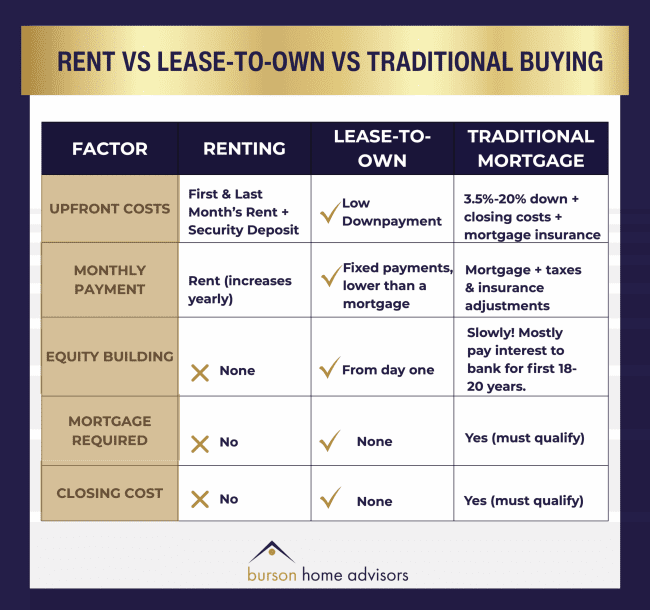

Great question—and an important one. The Lease to Own home programs we represent are nothing like the old rent-to-own models that left families unprotected. Every agreement is legally recorded at the courthouse and overseen by a licensed real estate attorney. You’ll have fixed monthly payments lower than a mortgage, full transparency, and clear legal safeguards from day one. Plus, unlike outdated models, you’re sharing in the appreciation – equity building – of the home you’re ‘leasing’. You also have the flexibility not to purchase. You can buy, transfer, or cash out—on your terms.

These programs were built for financially responsible families who are either in transition or aren’t quite mortgage-ready—but want to stop renting and start building wealth. That includes self-employed professionals, families selling a home, recent relocations, or first-time buyers still growing their credit. With a down payment as low as 2%, you can move into the home you love, lock in stable payments, and build equity from day one—without the hurdles of bank financing.

When your lease term ends—usually after three to five years—you have flexible options based on what’s best for you and your family. You can purchase the home using your built equity, transfer that equity into another home through one of our partners’ programs, or cash out if your life plans change. One of our partners allows you the flexibility to renew your lease option agreement for up to another five years.

No matter which path you choose, you’re protected and legally documented by a local licensed real estate attorney. This model is designed to support you, not trap you—so you can move forward with clarity, confidence, and financial freedom.

It all begins with a simple conversation. We’ll walk through your goals, preferred locations, and timeline to see if our or our partners’ Lease to Own home programs are the right fit. From there, you’ll complete a quick approval process—no hard credit pull required. No fee. No obligation, and only 10 minutes of your time.

Once approved, you can start touring homes that meet your lifestyle and budget. When you find “the one,” our partners purchase it for cash, and you move in under a legally protected Lease to Own agreement. From that day forward, your payments remain lower than a mortgage, and you begin building equity from day one.

“Relocating from Houston to Raleigh - and selling my home, I thought I’d have to rent, but Tamera and Jerry helped me lease a new home and start building equity right away. I’m beyond grateful for this option!”

Your Lease-to-Own home purchase is a profound life transition, a journey where entrusting your teammates is paramount to guiding you across the finish line. If you seek empathetic and exquisitely experienced teammates, look no further. We live for victories like yours!

"*" indicates required fields

"*" indicates required fields